|

|

|

| Step 1: Are you ready to

buy a home? |

| |

|

Over the years, I have

demonstrated the ability to save money

and am generally pleased with the amount

I've saved so far. |

|

I'm ready to change my

spending and life-style habits to support

the additional costs of paying for and

maintaining a home. |

|

I have worked hard to

earn a good credit rating and continue

to use credit wisely. |

|

I'm prepared to enter

into a long-term commitment for my family's

security, both physical and financial. |

|

Pride of ownership is

important to me, and I would enjoy the

chance to take care of my house, inside

and out. |

|

| If you have said yes to all

or most of these points, you may be ready

to buy a home. |

|

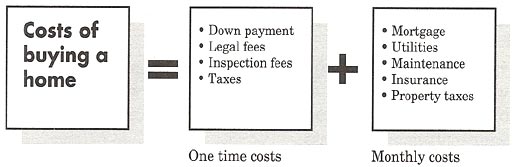

| Step 2 & 3: Cost of buying

a home |

| |

|

|

| Step 4: Deciding what to

buy |

| |

|

Single-family detached

- As its name implies, the home is not

attached to the home next door. Detached

homes come in three basic styles: bungalow,

or one-storey; two-storey, where the

entire home is two stories high; and

split-level, where one portion of the

house is one level and another is two

levels. |

|

Semi-detached or linked

- Two houses with a common wall between

them (or sometimes between garages or

basements). |

|

Duplex - A two-family

dwelling or house. |

|

Town house - Also

known as terrace or row housing, these

comprise several homes sharing the same

style, usually joined together by common

walls, although town houses can be detached.

In some town home developments the owner

owns the land as well as the home on

it. |

|

Condominium - A

condominium is not really a type of

home, but rather a legal term referring

to a form of collective ownership. Each

home "unit" is owned individually, while

common areas including the land are

owned jointly. Most building structures

can be set up as condominiums - apartments,

town houses, detached, semi-detached,

duplexes, commercial buildings, mobile

home parks, parking lots - anything

where there are advantages to be gained

from collective ownership. In Canada's

larger cities, condominiums are often

associated with high-rise buildings,

with complete recreational areas and

other shared amenities. |

|

| |

|

| Step 5: Selling your current

home to buy another |

| |

| The following are reasons /

factors why homeowners sell: |

|

Employment |

|

Family |

|

Financial position |

|

Lifestyle |

|

When should you sell?. |

|

Wait until the market

improves? |

|

The "seasonality" of home

sales |

|

Buy first or sell first? |

|

Bridge financing |

|

Sell with a Realtor's

help or go it alone? |

|

|

| Step 6: Working with a Real

Estate Professional |

| |

| Buyer's Agent |

A real estate company acting

as a "buyer's agent" must do what is best

for the buyer.

A written contract, called a buyer agency

agreement, establishes buyer agency. It also

explains services the company will provide,

establishes a fee arrangement for the REALTOR's

services and specifies what obligations a

buyer may have.

Typically, buyers will be obliged to work

exclusively with that company for a period

of time.

Confidences a buyer shares with the buyer's

agent must be kept confidential.

Although confidential information about the

buyer cannot be disclosed, a seller working

with a buyer's agent can expect to be treated

fairly and honestly. |

|

| Step 7: How your lawyer will

help |

| |

|

Making sure you will have

valid title (proof of ownership) to

the property and what it is described

correctly in every document. |

|

Investigating whether

there are any claims registered against

the property and ensuring these are

cleared before you take the title. |

|

Arranging for Title Insurance

on your behalf, to protect you and the

lender against defects in property's

title or zoning. |

|

Checking with the appropriate

municipalities to find out if taxes

are owing on the house, or (in the case

of a new home), if final inspection

has been completed. |

|

Calculating the amount

of Land Transfer Tax you will be required

to pay when you complete the transaction,

as well as any adjustments necessary

to compensate the seller for prepaid

fuel (in the oil tank), taxes and utility

bills. |

|

Drawing up the mortgage

documents, if these are not prepared

by your lender's lawyer. |

|

|

| Step 8: Making an offer |

| |

| Preparing the offer |

| |

If this is the first time you've

purchased a home, you probably have never

seen an Agreement of Purchase and Sale before,

let alone drafted one. Not to worry. The Realtor

is knowledgeable about this subject and will

prepare your offer, taking into account all

the factors that are important to you.

Fortunately, Realtors don't have to reinvent

the wheel every time there's an offer to be

drafted. Standard Agreement of Purchase and

Sale forms are used by most real estate boards

and contain terms common to almost every real

estate transaction in the province. The wording

on these forms has been thoroughly reviewed

and tested through Ontario's legal system,

and is broadly accepted. That doesn't mean

however, that your specific offer cannot also

include special conditions you want. Every

sale is different, and your offer will contain

the wording that suits your needs. |

|

| Step 9 & 10: Arranging a

mortgage and other costs |

| |

|

Ask your employer for

a letter confirming your employment. |

|

Make a list of your assets

(cars 0 even if you owe money on them

- savings accounts, GICs, stocks, bonds,

etc.) |

|

Also list your liabilities

(the things you owe money on - car loans,

student loans, credit card balances,

etc.) |

|

Subtract your total liabilities

from your total assets; the remainder

is your net worth |

|

Itemize the source(s)

of your down payment giving account

numbers where appropriate. |

|

Also come prepared with

your social insurance number, chequing

account information and contact information

for your lawyer |

|

If you've already selected

the home you want to purchase, bring

along any information that will help

describe it. |

|

|

| Step 11: The Home Inspection

|

| |

| The most reliable indication

of a home inspector's qualifications is membership

in the Ontario Association of Home Inspectors

(OAHI), the Provincial Association of Certified

Home Inspectors (PACHI) and/or the Canadian

Association of Home Inspectors (CAHI). |

|

| Step 12: Closing the deal |

| |

|

Make sure a copy of the

signed Agreement of Purchase and Sale

is sent to your lawyer right away. |

|

Immediately begin satisfying

any conditions of the agreement that

require action on your part. |

|

Upon your direction and

after the conditions have been met,

your lawyer will begin searching title

to the property. |

|

If you so decide, your

offer should contain a condition that

the property pass inspection by a professional

home inspector. |

|

If no current land survey

exists on the property, arrange for

one soon. |

|

Contact your lending institution

and have them begin the process of finalizing

your mortgage documents. |

|

Your lawyer will contact

the seller's lawyer with any questions

or issues regarding title and costs

that have to be resolved before closing

can take place. |

|

Hydro, gas and water companies

serving the property will be contacted

by your lawyer for final meter readings

on the day of closing. |

|

If you currently rent,

you'll need to give notice to your landlord

or sublease your apartment. |

|

Begin making arrangements

to move your possessions from where

you live now into your new home. |

|

Meanwhile, your lawyer

will be busy gathering a number of different

reports, certificates and clearances

form various governmental offices |

|

If your lender is not

going to draw up the mortgage papers,

your lawyer will do this for you. |

|

Send out your change of

address notices and fill out a card

at the post office. |

|

Well before closing, contact

your insurance agent to arrange homeowner's

insurance coverage to become effective

on the date of closing. |

|

Your lawyer will review

and verify the draft deed (the document

that transfers ownership from the seller

to you), statement of adjustments and

other closing information provided by

the seller's lawyer, and will deal with

any problems as they arise |

|

A day or two before closing,

you'll meet with our lawyer to go over

and sign the closing documents |

|

|

| Step 13: Making a "smooth"

move |

| |

|

Who will handle your move? |

|

Working with a professional

moving contractor? |

|

Do it yourself? |

|

Sell with a Realtor's

help or go it alone? |

|

| Top |